Industry

Take AI From Vision to Value

See how a value-driven approach to AI can accelerate time to impact.

In the ever-evolving financial landscape, lenders are continually seeking innovative strategies to make more accurate, reliable, and swift credit decisions. At Evolve AI Labs, we stand at the forefront of this transformative era, leveraging the power of cutting-edge machine learning technologies to revolutionise credit risk assessment.

Ongoing Economic Uncertainty: Navigating the ever-evolving regulatory landscape while maintaining model performance in changing market conditions is a constant challenge. The persistent economic uncertainty challenges lenders in accurately assessing the credit quality of borrowers and sectors vulnerable to economic changes.

Complexity and Interpretability: Our primary challenge is balancing the advanced algorithms of ML models with their interpretability. We need models that are not only powerful but also transparent and understandable, both for effective management and clear communication with stakeholders.

Fairness and Bias: Another critical issue is ensuring fairness and avoiding bias in ML models. These models can inadvertently reflect biases present in the data, potentially discriminating based on sensitive attributes. Our task involves continually scrutinising and adjusting models to prevent such biases.

Extensive Documentation: MRM teams are often required to develop comprehensive documentation on the development methodologies of credit risk models. These documents are lengthy and cover the full spectrum of experimentation and testing results. This is even more important for third-party model developers.

Intelligent Quality Assessment:

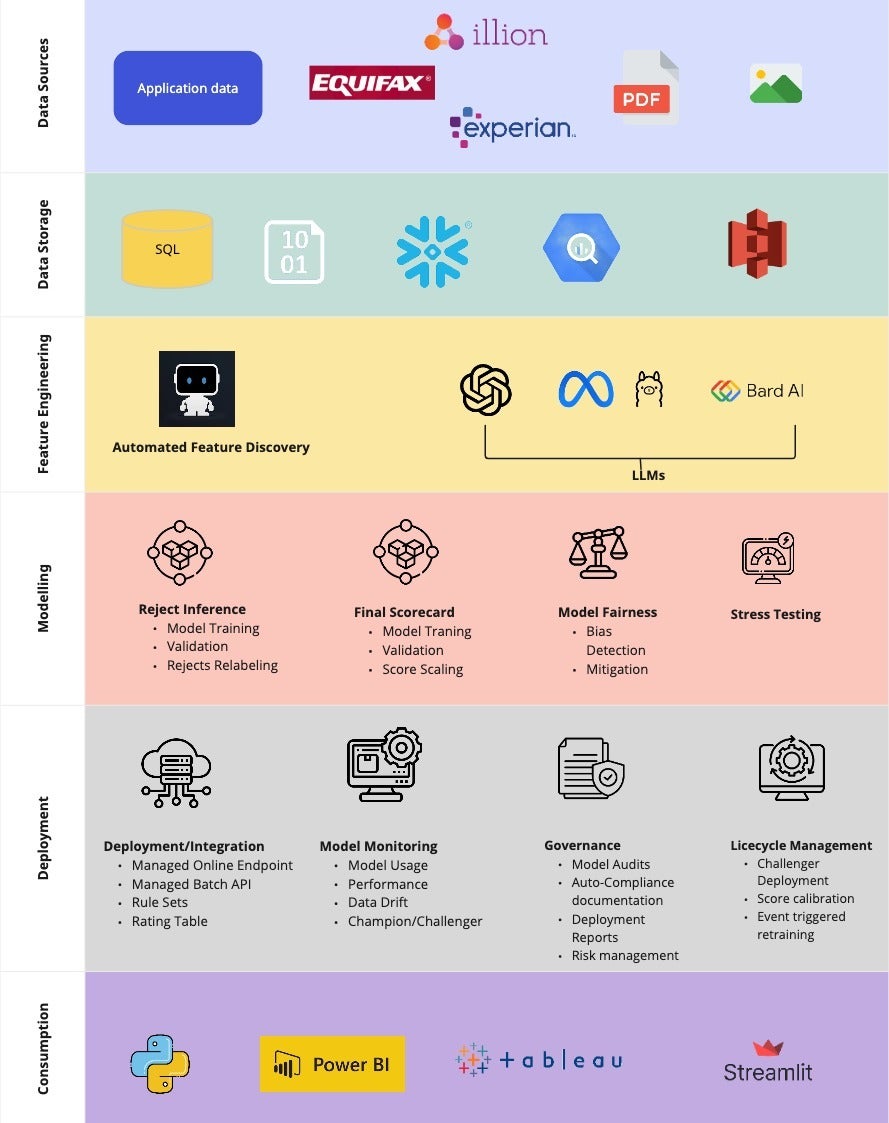

Our cutting-edge credit scorecards goes beyond logistic regression models and uses algorithms which captures complex relationships in your data without compromising on the interpretability. Our solution uses sensitivity tests to assess risk, enabling you to set customised cutoff thresholds for auto approvals, reviews, and auto declines. We leverage the latest LLMs to perform contextual feature engineering to capture the underlying behavioural signals near real time.

Advanced Model Testing:

We provide detailed analyses of individual exposures and credit portfolios against potential future economic changes, including stressed conditions. Our services include regular, granular stress testing tailored to the nature of your credit portfolio, incorporating severe but plausible scenarios. We leverage latest mlops concepts like champion challenger to compare model versions to identify output trajectory and prediction drifts.

Seamless Integration:

We understand the importance of seamless integration within your existing origination systems. Our credit scorecard solution seamlessly integrates with common platforms such as Snowflake, Redshift, RDBMS, and third-party APIs like Equifax and Experian. We offer a wide range of deployment options from rule engines to real time APIs. These integrations ensure your customer facing teams have all the necessary information to make the decision.

Continuous Monitoring:

Failure to identify and measure the ongoing deterioration in credit risk in real time may lead to higher future losses and capital reserve inadequacy. We constantly monitor the impact on borrowers from changing marketing conditions like rising interest rates, high inflation and market volatility. Constant monitoring and refinement ensure that our scoring systems remain accurate and aligned with your evolving risk appetite.

Customisation and Personalisation:

We recognise that each lending institution has its own unique requirements and risk tolerances. Scorecards can take several forms, from predicting Probability of Default to discrete numbers. We provide customisable scaling factors to convert the odds to logical score ranges for non-experts.Our AI-agent driven solution offers a competitive edge by providing declined loan applicants with clear explanations and tailored advice, encouraging future reapplications. These agents are fully configurable and ensure human oversight minimising any operation risk.

Auto-compliance documentation:

Our solution leverages a combination of DataRobots Compliance Document and proprietary LLMs to develop documentation reports that provides the MRM team with appropriate transparency into the model development process related to design, theory , assumptions and logic.

Evolve AI is a machine learning research lab dedicated to addressing the challenges of resource concentration in the field. Inspired by collaborative scientific ventures, our mission is to provide technical services including advanced data analytics, bespoke machine learning solutions, and comprehensive AI infrastructure to organizations of various sizes. Our core focus is on solving real-world problems and delivering tangible value through machine learning, with a commitment to responsible and ethical development.

Credit decisioning scorecards by Evolve AI Labs, offer a state-of-the-art solution to address lending challenges. These scorecards utilise advanced machine learning technology for precise borrower credit assessments and minimal default risk.

Our commitment to regulatory compliance ensures high standards, with rigorous stability testing under diverse economic conditions. This comprehensive solution streamlines lending processes, enhances risk management, and adapts to evolving risk profiles within a robust governance framework.

Whether you choose implementation or consulting services, we provide comprehensive support. We ensure your AI/ML models meet compliance and performance standards, offering detailed reports and analyses to guide your team through testing phases. With Evolve AI Labs, you can trust in expert credit decisioning processes fit for the dynamic financial landscape.

In the world of personal finance in Australia, a prominent lender faced challenges as the market evolved and borrower creditworthiness was impacted by COVID-19. They turned to Evolve AI Labs for assistance in revamping their credit scoring system to account for these changes and enhance their loan portfolio performance.

Evolve AI Labs, using DataRobot’s capabilities, developed advanced precision risk scorecard models tailored to various loan products where each model underwent rigorous testing and regulatory approval. Additionally, Evolve AI Labs were involved in developing the expected credit loss (ECL) framework to comply with accounting standards such as IFRS9 and AASB 9.

Loan approval processes sped up thanks to more accurate risk assessments from the new internal scorecard. Borrowers benefited from personalized risk-based pricing, allowing for lower interest rates as their credit improved during the loan term. Additionally, Evolve AI Labs implemented a hybrid strategy that reduced bad rates for one segment of customers without compromising approval rates, while another segment maintained similar bad rates but with a 20% increase in approval rates.

The value delivered by Evolve AI Labs extended beyond utility, encompassing enhanced operational efficiency and the identification of previously overlooked market segments. This transformation led to a more robust and prosperous loan portfolio.

Industry

See how a value-driven approach to AI can accelerate time to impact.